While the legal process of divorcing can be difficult, it doesn’t have to be financially arduous for everyone involved. A divorce checklist can help you in this situation to set things in the right direction. There are various methods to choose from based on how you want to handle things financially while divorce proceedings occur.

In the divorce process, the two parties focus their energy on how much they need to spend, what rate of interest can be paid, and the type of debt that should be paid back first. It’s important to know how to work with your divorce financial analyst and what steps you should take in order to minimize your financial stress during a divorce.

This article is a brief financial guide for people going through a divorce. It’s meant to help you make decisions and plan your finances so that you’re not left scrambling because of a split from your partner.

No matter how tedious or complex the process may be, here are eight helpful tips (a divorce checklist) that every married couple should follow when heading down the financially draining route of separation.

Setup Separate Accounts

The foremost financial step you should take after your divorce is to establish separate accounts. This will give each person an equal footing when it comes to money management and can help prevent arguments over money.

It is critical to establish separate bank accounts for yourself and your children. This is because the child support guidelines require that all child support payments be paid directly into the parent’s account. Making this list in advance can help you prevent unexpected situations in the future.

Compute Your Income After Divorce

Once you have been divorced, the next major step is to determine your post-divorce income. This is not an easy task, but it can be done with careful planning and research.

You’ll need to take into account factors like your current living situation, the amount of time you spend working for your spouse, what type of divorce agreement you need to make, what amount is needed to support you, what your child support payment deadlines are, and how to adjust your budget after divorce to reflect your post-divorce income.

You should also consider how much money you make from sources other than your job—for example, if you have a 401(k) plan that allows your former spouse to contribute to it.

Finally, if your family relies on one spouse for childcare or other household expenses, it’s crucial to know whether that person will still be able to provide those services once they’re no longer married.

Make a New Budget Plan for Your Household

When you’re going through a divorce, it can be hard to think about money. But there are some important financial steps to take once your divorce is final that will help you feel better about your situation and give you the tools necessary to move forward with your life.

First, make a budget that works for you and your new household. Once you have a budget in place, it’s much easier to know where to cut back, how to avoid incurring additional debt, and/or where to invest. And if you have an idea of what your current spending habits are like, it’s easier to spot any areas where there might be room for improvement.

Second, make sure that your finances are stable before moving forward with any long-term plans or dreams—like buying a house or starting a family.

Third, don’t let anyone pressure you into doing anything impulsively just because they want quick results (even if they sound convincing). Take time to evaluate what’s best for YOU, and then move forward accordingly!

Establish Your Own Retirement Strategy

Once your divorce is finalized, it’s time to start thinking about your own retirement.

A retirement plan can help you save for the future and feel more financially secure. It’s also an excellent way to ensure that your family has a stable financial future, which could be crucial if you’re in an unstable financial situation after a divorce.

A financial expert will have many options for you. One possible suggestion would be to set up your own Individual Retirement Account (IRA) that offers you tax incentives such as tax-deferred growth. You can also request a Qualified Domestic Relations Order (QDRO) as part of your settlement agreement. A QDRO is a court order that allows one spouse to take money or property from another spouse’s retirement account without tax consequences.

You can use the information given to properly assess what would be most helpful for your situation— then find a trusted financial professional who can help guide you through the process of rebuilding your personal financial plan.

Choose What You Want to Do With the House

In a divorce, you may have to make a decision about whether to keep your home. It is vital to be proactive about this process and talk about it with your spouse. This can help you avoid any surprises down the road and ensure that you are both on the same page moving forward.

One option is to let your former spouse buy out the house in exchange for an agreed-upon price. Another arrangement could be to co-own the property with your former spouse based on a financial agreement. If none of these options work, then you and your former spouse agree to simply sell the house and split the profits.

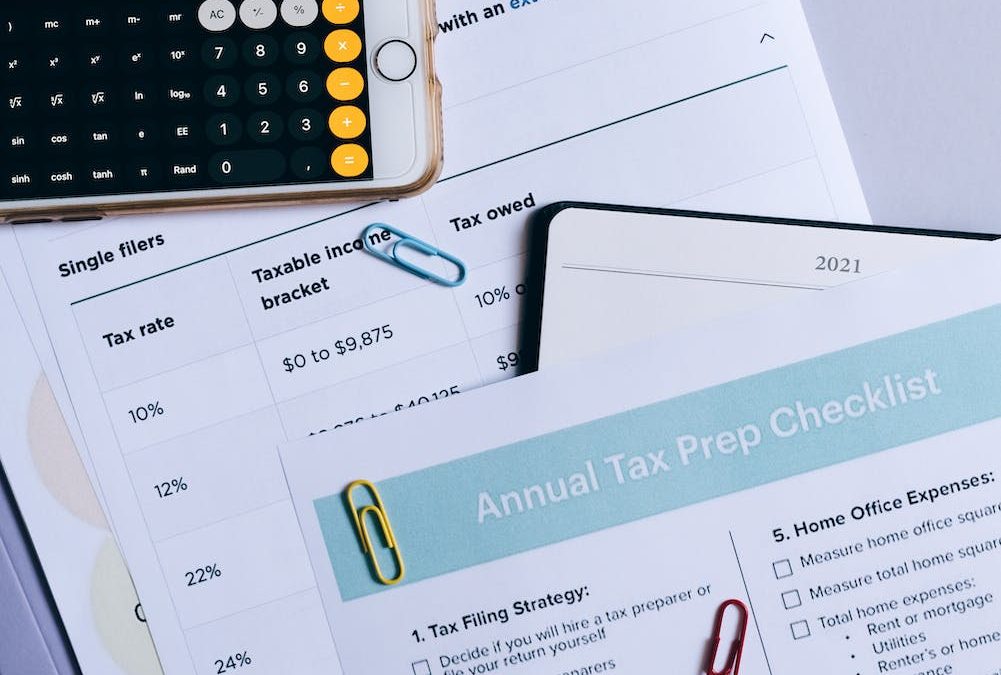

Organize and Have Ready ALL of Your Financial Documents

Understandably, you might not want to tell your former spouse everything after your separation. However, hiding anything from your representative or the court during a divorce can lead to serious legal consequences.

Hiding any assets through the transfer of money or using an offshore account might seem like a flawless plan at the time until the IRS comes knocking down your door.

Instead, plan on telling and giving your team everything: all of your documents, accounts, tax returns, and anything else that they ask for. They are here to help you, so you’re going to have to help them too.

That includes being honest with your attorney or advisor about previous concealments or any considerations. They will steer you in the right direction.

Prepare Yourself to Make Compromises

Divorce should not be considered a competition; no one will be the “winner” at the end of the day. Whether you’re dealing with child support, property division, or alimony, you’re going to have to work with your spouse toward an agreement.

Even if you aren’t on the best terms with your former partner, the decisions you make now can and will affect you for the rest of your life; you might as well work together toward fair trade.

It’s essential to keep those around you in mind as well—they are making compromises, too.

Get Professional Support to Help You Through It

No matter how prepared you are, divorce can be complicated. Separating from your partner and interfering with the lives of your children is no easy task; no one should have to go through it alone.

Fortunately, many experts are knowledgeable and ready to help in any situation. Talking to a public accountant or advisor should be your next step, a step towards a peaceful and successful divorce.

Don’t forget to talk to friends, family, or a therapist for support as well. You should avoid speaking ill of your spouse in front of your kids; after all, this is an adult situation. That said, reaching out to someone you can lean on can take a load off your shoulders as you navigate this process.

Need help getting through the challenging aspects of divorce? We can help! The Certified Public Accountants (CPAs) at Miod and Company can navigate you through the complexities of the financial aspects of your divorce. Schedule a free consultation to find out how we can help.