by Tony Luu | Dec 30, 2022 | Business Valuation, Litigation, Tax

In California, there are three basic ways of tracing separate or communal property. Direct Exhaustion/recapitulation Mechanical Tracing Lawyers and forensic accountants utilize these strategies to substantiate separate property claims against current and existing...

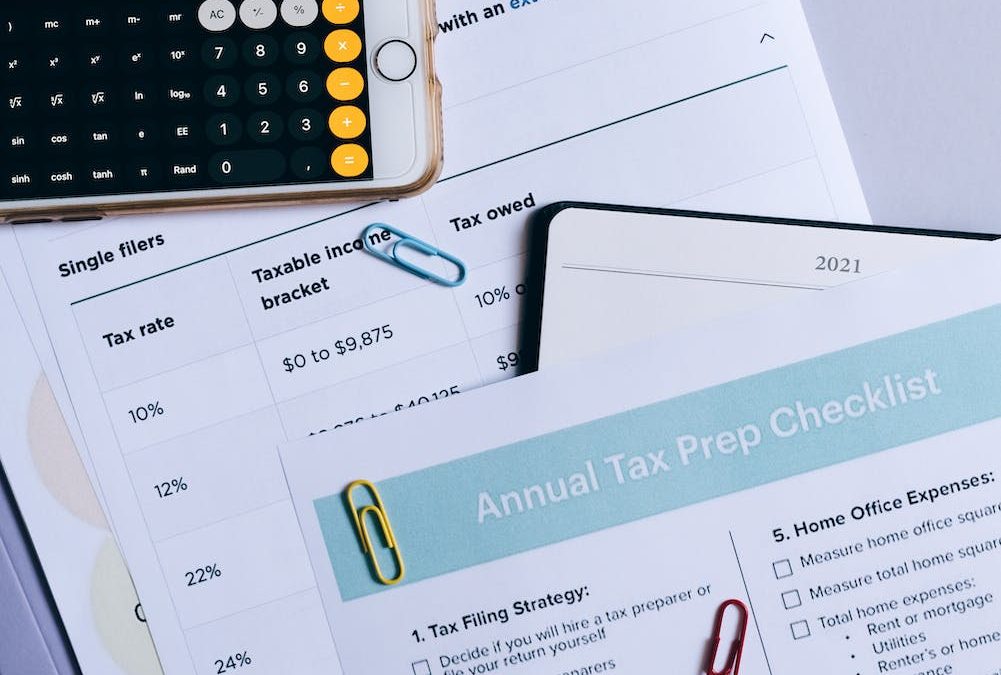

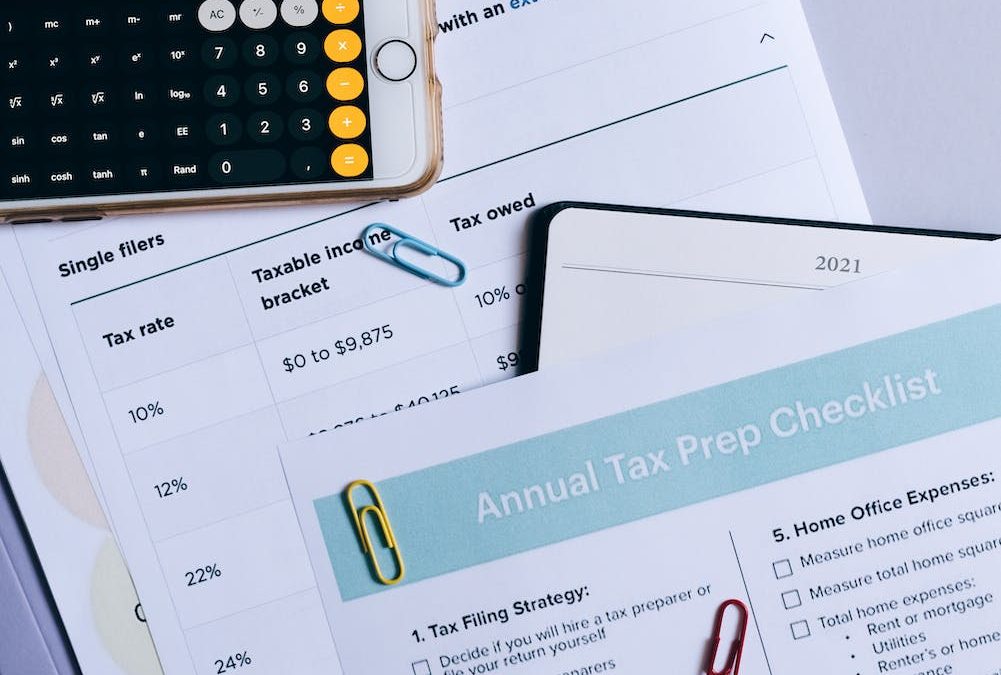

by Tony Luu | Dec 1, 2022 | Business Valuation, Family Law, Litigation, Tax

While the legal process of divorcing can be difficult, it doesn’t have to be financially arduous for everyone involved. A divorce checklist can help you in this situation to set things in the right direction. There are various methods to choose from based on how...

by Tony Luu | Nov 23, 2022 | Business Valuation, Family Law

The characterization of property in a divorce or legal separation case is extremely important. The distinction between separate and community property has a substantial impact on the division of assets upon divorce. The definition of separate property is any property...

by Tony Luu | Nov 1, 2022 | Business Valuation, Family Law, Litigation

Rethinking the Role of Forensic Accountants in Divorce Cases Author: Miod & Company Date: November 1, 2022 Category: Business Valuation, Family Law, Litigation Average Time Reading: 9 minutes Forensic accountants in divorce cases investigate complex financial and...

by Tony Luu | Oct 22, 2022 | Business Valuation, Tax

5 Reasons Californians Should Be Thinking About Audit of Financial Statements Their Companies ? Author: Miod & Company Date: October 22, 2022 Category: Business Valuation, Tax Average Time Reading: 8 minutes An audit of financial statements is beneficial for the...

by Tony Luu | Oct 21, 2022 | Business Valuation, Family Law, Litigation

Four Key Considerations During Divorce Estate Planning Author: Miod & CompanyDate: October 21, 2022Category: Business Valuation, Family Law, LitigationAverage Time Reading: 4 minutes During divorce estate planning, you will go through a lot of changes. You will...